XRP Price Prediction: Can Ripple Rally to 30$+ Due To Bank of Japan Usage of Ripple

/PlutoChain/ – Japan’s banks are gearing up to integrate XRP for transactions — a move confirmed by SBI Holdings CEO Yoshitaka Kitao. If this goes through, it could slash costs and streamline global payments.

Meanwhile, Bitcoin’s slow speeds and high fees are still a headache. That’s where PlutoChain ($PLUTO) could come in. As a hybrid Layer-2 solution, it might be able to make Bitcoin faster, cheaper, and more efficient.

Here’s what you need to know.

XRP Price Prediction: Will Japan’s Banking Shift Send XRP Soaring?

XRP is trading at around $2.50, down 3.6% in the past 24 hours and 7.5% over the last week. But a major move could be on the horizon — Japan’s entire banking sector is gearing up to integrate Ripple’s XRP for transactions.

SBI Holdings CEO Yoshitaka Kitao has confirmed this transition, which could redefine cross-border payments, lower costs, and position XRP as a dominant force in global finance. With Japan’s $6.37 trillion banking industry backing it, this shift could have ripple effects across both crypto and traditional markets.

The plan is to use XRP for seamless money transfers and currency exchanges. Its speed and low transaction costs make it an efficient alternative to outdated banking systems. SBI Holdings, a long-time supporter of XRP, has collaborated with Ripple since 2016, proving its value in international payments.

By serving as a bridge currency, XRP eliminates delays and high fees, making global transactions more efficient. Some experts believe this could elevate XRP’s global standing and push other countries to follow suit.

According to technical analyst Charting Guy, these developments could drive XRP’s price to $4 — and possibly even $8 in the near future.

PlutoChain ($PLUTO) Is a Powerful Hybrid L2 Platform That Could Solve BTC’s Biggest Headaches and Bring Major New Features to the Ecosystem

Bitcoin’s biggest challenges — slow transaction speeds and high fees — have long limited its ability to function as a truly scalable digital currency. But PlutoChain ($PLUTO) could finally change that.

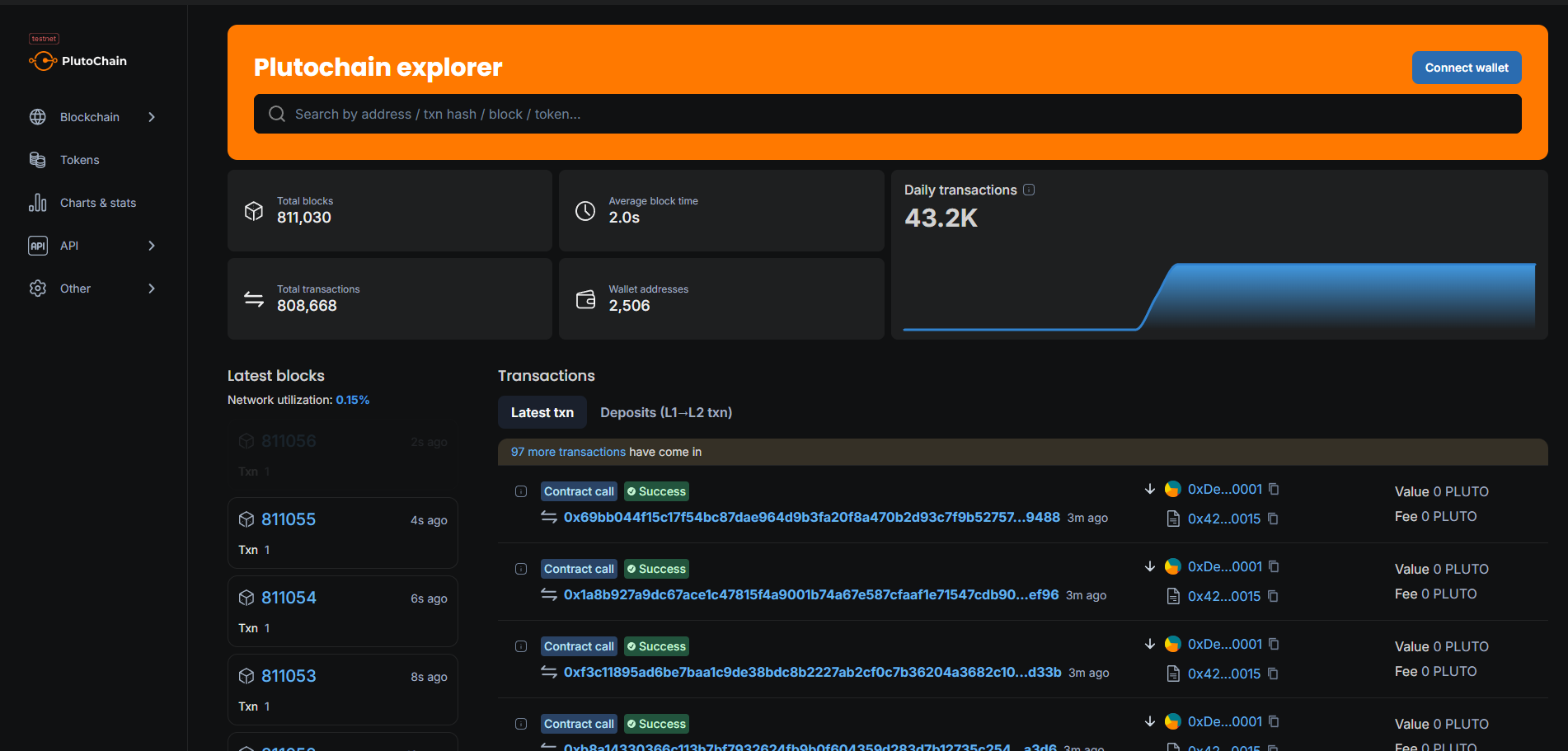

Right now, Bitcoin block times take around 10 minutes to confirm. PlutoChain’s Layer-2 technology could process these block times in just 2 seconds on its own layer, potentially improving speed and usability.

One of PlutoChain’s key advantages is its compatibility with Ethereum’s Virtual Machine (EVM).

This means developers could easily port projects between networks, allowing Bitcoin to integrate with decentralized applications (dApps) and smart contracts — something Bitcoin’s native infrastructure has struggled to support for a decade.

Early tests show PlutoChain can handle over 43,200 transactions per day, potentially proving its ability to scale in the real world.

Security is also a priority, with audits from firms like SolidProof, QuillAudits, and Assure DeFi ensuring the integrity of its code.

Apart from speed and security, PlutoChain introduces a governance model that lets users vote on key decisions, giving the community more control over the platform’s future.

By solving Bitcoin’s long-standing efficiency problems, PlutoChain could make digital payments faster, cheaper, and more accessible — helping Bitcoin reach its full potential in the innovative blockchain industry.

The Bottom Line

Japan’s move to integrate XRP could significantly increase its global adoption and market value. If it proves successful, other nations might follow suit, which could accelerate the shift toward XRP-powered transactions.

Meanwhile, PlutoChain ($PLUTO) may have the potential to address Bitcoin’s biggest roadblocks. If its technology delivers as expected, Bitcoin could become faster, more efficient, and a more practical option for daily transactions.

This article is not financial advice. Past results are not indicative of future returns, and the crypto market is inherently unpredictable. Readers must conduct their own thorough research before purchasing any crypto coin or token. These forward-looking statements are subject to risks and may remain unchanged.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.