With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

“When FTX collapsed, we saw the opportunity,” said Bybit co-founder and CEO Ben Zhou, referencing the downfall of Sam Bankman-Fried’s once-dominant exchange.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

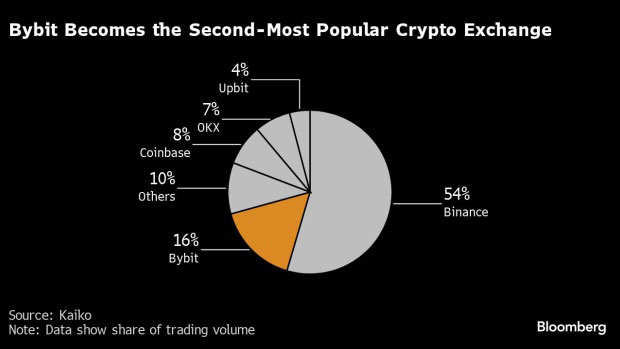

Bybit, a crypto exchange based in Dubai, has become the second-largest in the world by trading volume. This growth came after the collapse of the fraudulent exchange FTX, according to Bloomberg. The meteoric rise highlights both the ongoing recovery of the crypto market and the evolving regulatory landscape.

Photo: Kaiko

Bybit’s coup comes after the exchange strategically targeted former FTX users alongside a growing user base in Europe and Russia. “When FTX collapsed, we saw the opportunity,” said Bybit co-founder and CEO Ben Zhou, referencing the downfall of Sam Bankman-Fried’s once-dominant exchange.

The exchange’s unique margin trading service that allows over 160 tokens as collateral has also driven its growth. “This was something that no one else had,” Zhou highlighted. Since October, Bybit’s market share has doubled to 16%, surpassing the US leader Coinbase in March, according to Kaiko data. Now, Bybit is second only to Binance in spot and derivatives transactions.

Bybit’s recent success reflects the overall recovery of the cryptocurrency market. Bitcoin price has doubled over the past year, driven by the introduction of dedicated US exchange-traded funds (ETFs). This recovery marks a significant rebound from the 2022 bear market and scandals, including the FTX collapse.

The crypto exchange has taken advantage of this positive trend by offering innovative features. Their cross-margin trading accounts allow users to leverage unrealized profits for new positions, appealing to traders looking for an advantage in the recovering market.

Europe remains Bybit’s largest market, accounting for 30-35% of total volume. The Commonwealth of Independent States (CIS), primarily Russia, contributes around 20%. However, Bybit faces challenges in Russia, where crypto usage is closely monitored due to potential sanctions violations related to the Ukraine war.

The exchange screens Russian clients carefully and strictly follows sanction rules. To enhance its compliance efforts, Bybit is opening an office and seeking a digital-asset license in neighboring Georgia, following a permit obtained in Kazakhstan last year.

Bybit’s growth coincides with Binance’s recent $4.3 billion settlement with US authorities for sanctions and anti-money laundering (AML) violations. This hefty fine and jail time for Binance co-founder Changpeng Zhao highlights the increasing regulatory control over the digital asset industry.

Bybit, previously known as an exchange for overseas customers, is adjusting as regulations change. Zhou notes that Europe’s new Markets in Crypto-Assets Regulation (MiCAR) limit some products, leading Bybit to seek new growth areas like Brazil, Turkey, and Africa.

The exchange is also focusing on its relationship with prime brokers, key players in crypto market liquidity by linking institutional traders with exchanges. In May, Bybit announced a “compliance review” of its prime broker interactions. “Now, if you are a prime broker, we have to know who are you dealing with,” Zhou said.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.