A breakout below the support level of $3,094 will further decline in Bitcoin price towards $2,261 – $1,500 price level. Traders can remain flat as long the consolidation continues.

Key Highlights:

- Traders should remain flat;

- bulls may take over the Bitcoin market in case there is a breakout above $3,726;

- break out is imminent.

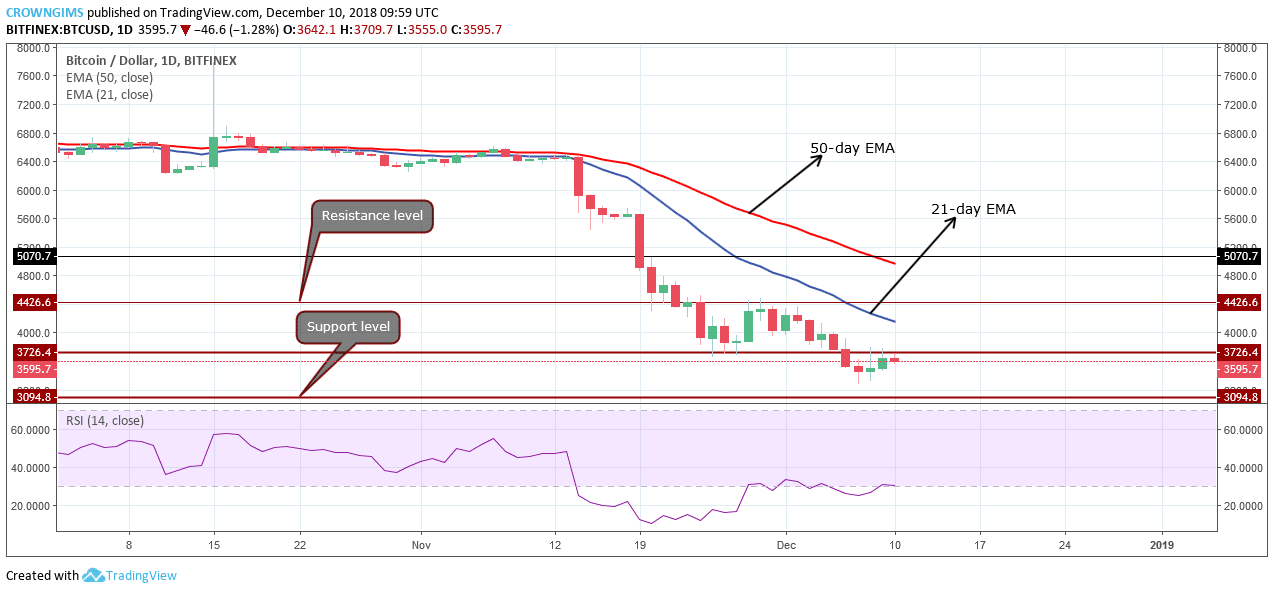

BTC/USD Long-term Trend: Ranging

Resistance levels: $3,726, $4,426, $5,070

Support levels: $3,094, $2,261, $1,500

Although BTC price remains below the 21-day EMA and 50-day EMA as a sign of a bearish trend, the Relative strength index period 14 is on the 30 levels parallel/flat to the level without direction which indicates that consolidation is ongoing.

Should there be a clear penetration above the resistance level of $3,726 then the bullish rally will be anticipated towards the supply level of $4,426 – $5,070. A breakout below the support level of $3,094 will further decline in Bitcoin price towards $2,261 – $1,500 price level. Traders can remain flat as long the consolidation continues.

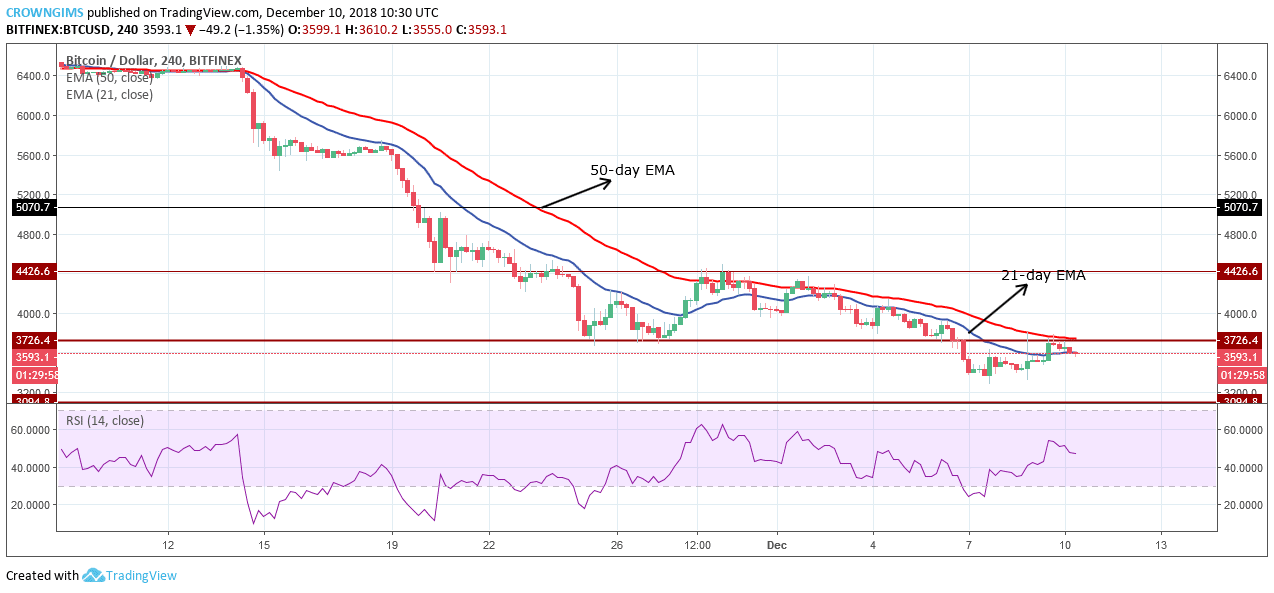

BTC/USD Medium-term Trend: Ranging

BTC/USD is ranging on 4-Hour chart. The coin has been range bound between the resistance level of $3,726 and the support level of $3,094 since December 6, shortly after the support level of $3,726 is broken downside.

The Bitcoin price is currently in between the 21-day EMA and 50-day EMA and the two EMAs were flat which indicates that consolidation is ongoing on the 4-Hour chart on the BTC market. However, the Relative Strength Index is above 40 levels bending to the south which connotes sell signal.

next