The strong bearish daily candle that broke down and closed below the $3,679 price level yesterday, followed by another bearish candle today implies that Bitcoin may find support at the previous low of $3,247.

Key Highlights:

- Bitcoin price broke out of the ranging movement;

- the Bulls lost the momentum on the 4-Hour chart;

- there is a probability for further declination of BTC price.

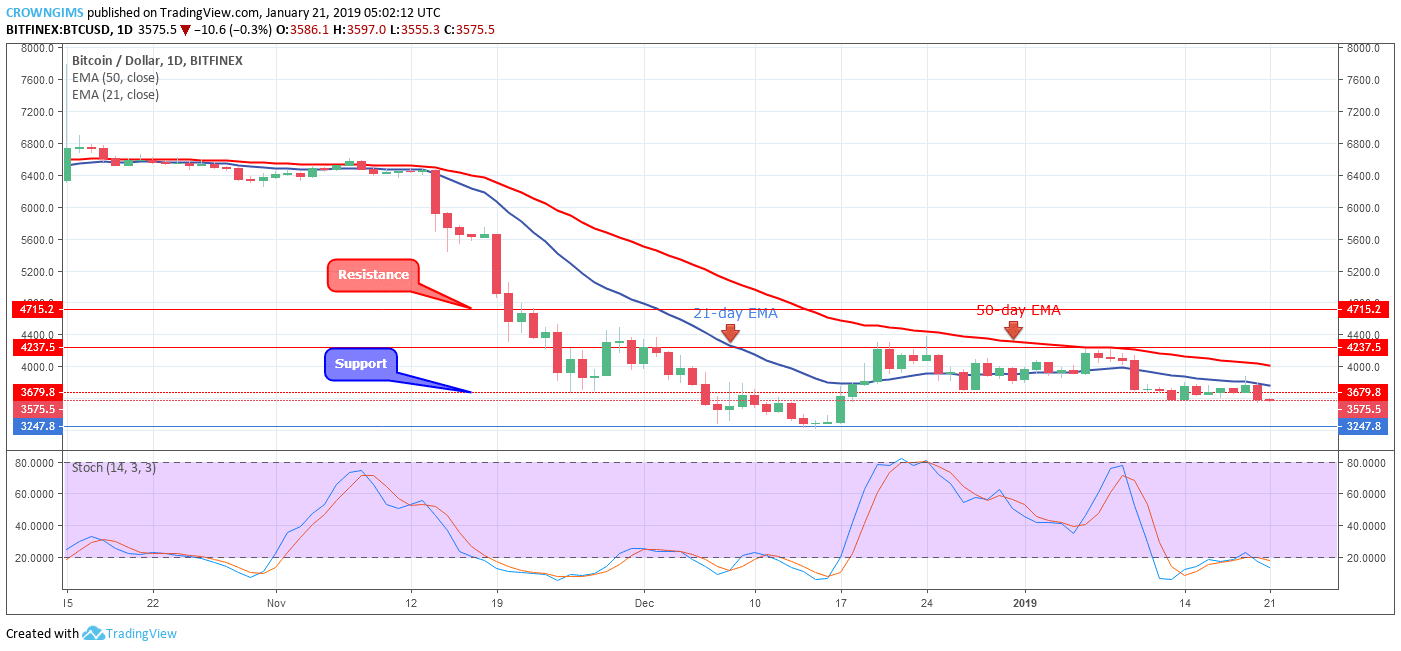

BTC/USD Long-term Trend: Ranging

Resistance levels: $3,679, $4,237, $4,715

Support levels: $3,247, $2,765, $1,956

The 50-day EMA remain above the 21-day EMA while the BTC price continues trading under the later which indicate that the bears were still holding to the BTC market. The Stochastic Oscillator period 14 is below 20 levels (at the oversold level) with its signal lines pointing down connotes further declination of BTC price and sell signal.

The strong bearish daily candle that broke down and closed below the $3,679 price level yesterday, followed by another bearish candle today implies that the coin may find support at the previous low of $3,247.

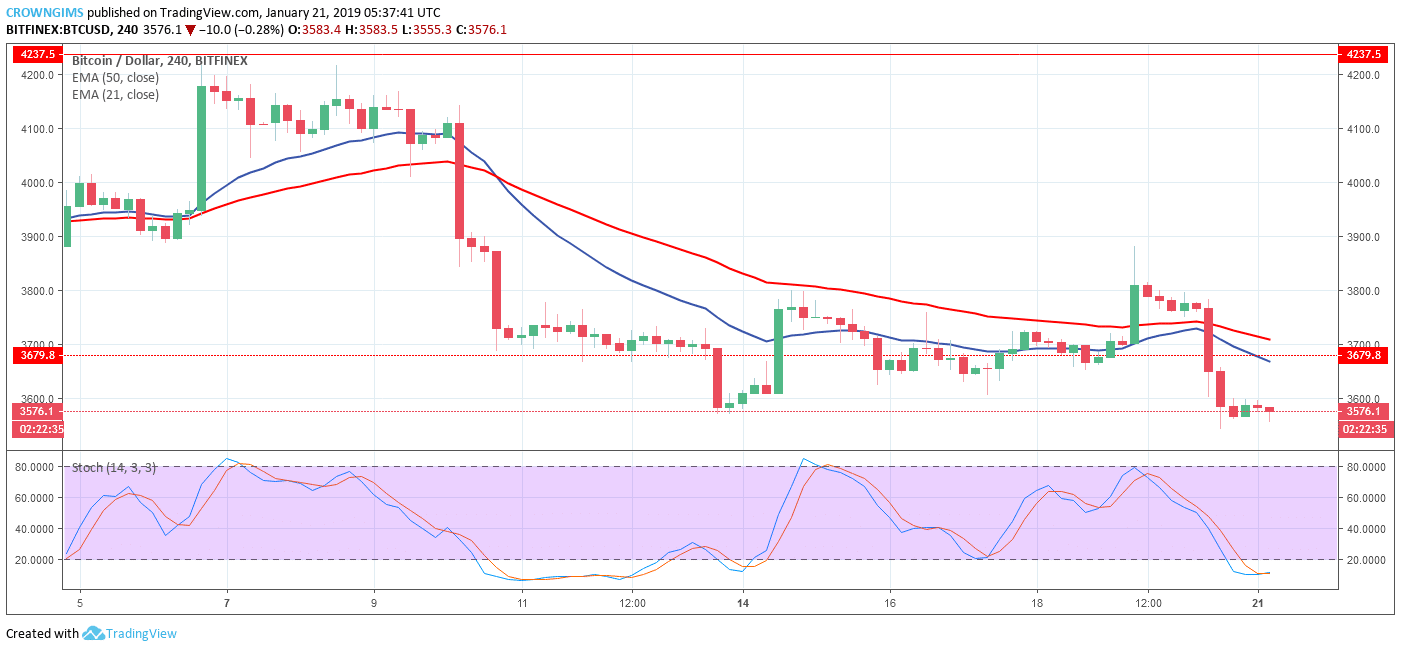

BTC/USD Medium-term Trend: Bearish

The coin is trading below the 21-day EMA and 50-day EMA with the two EMAs bending to the south as a sign of bears’ pressure. However, the stochastic Oscillator period 14 is below 20 levels (oversold level) twisted to each other and flat horizontally which indicates that the coin may experience consolidation for a short period of time.

next