According to analysts, “BTC funding rates indicate the significant use of leverage… this leaves us susceptible to 2-way volatility.”

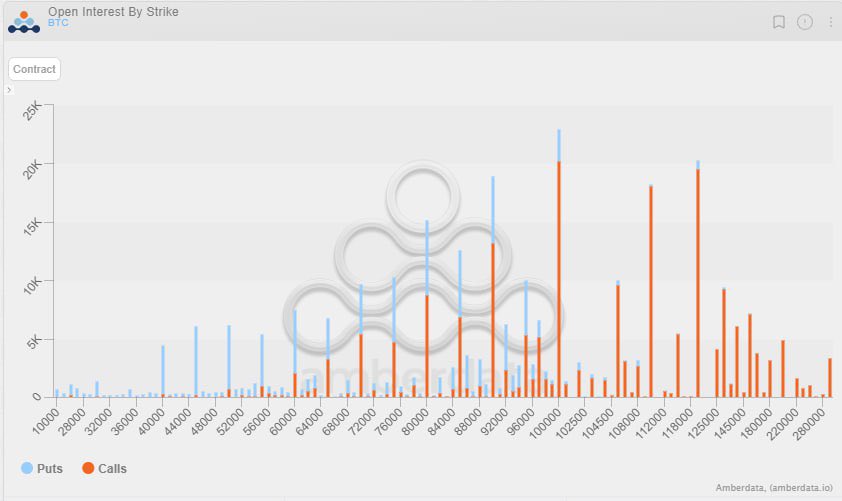

Despite the expected price volatility of around $100K, Bitcoin BTC $96 611 24h volatility: 2.1% Market cap: $1.92 T Vol. 24h: $29.09 B options traders have increased bets on $110K and $115K price targets by January 2025. According to the latest insights from the options exchange Deribit, most traders bought more call options (bullish bets) for a $115K price target by 31st January 2025.

At press time, the largest options expiries by Open Interest (OI) were in December 2024 and March 2025. Galaxy Digital’s Kelly Greer noted that about $4B in OI was being betted on the BTC price, hitting $100K and $110K (strike prices) by the end of 2024 or Q1 2025.

However, with BTC recently tapping $100K, some aggressive bets were also placed on the $120K target.

Leverage Risk Remains

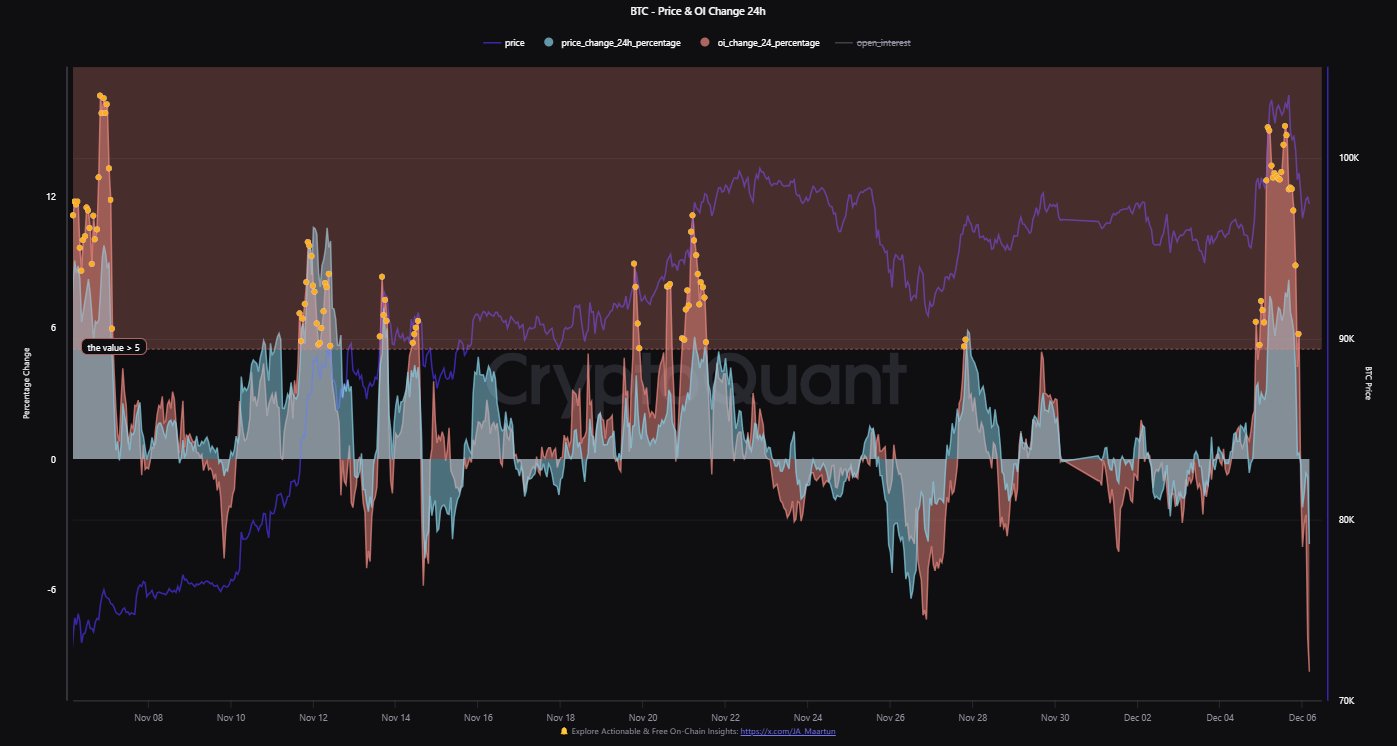

Despite the bullish outlook from the options market, BTC could face wild price swings on what analysts have blamed on high-leveraged (borrowed money) players and greed. According to CryptoQuant’s JA Martunn, the recent flash crash from $104K to $90.5K was driven by leverage.

“Leverage-driven pumps indicated significant risk, as the price surge was fueled by leverage. Open interest rose by more than 15%,” wrote Martunn.

Historically, leverage-driven rallies have led BTC to face sharp pullbacks and local tops. Additionally, they trigger wild volatility as leveraged positions are liquidated, exacerbating price swings. The recent BTC flash crash exposed the broader market to $1B of liquidations.

Sharing his thoughts on the same, Jake Ostrovsksis, options and OTC (Over the Counter) trader at market maker Wintermute, cautioned that the BTC market was susceptible to 2-way volatility.

“Flow remains undeniably strong with topside continuing to block, however, funding rates indicate the significant use of leverage… this leaves us susceptible to 2-way volatility,” Ostrovsksis told Bloomberg.

That meant that despite the bullish sentiment in Options, the market could still witness a +$10K price swing on either side, just like on December 5.

That being said, BTC price was back in its short-term ascending channel chalked since mid-November. However, it was muted below a key roadblock at $98K. A surge above it could push it to the mid-range and the short-term upside target of $105K.

However, a breach below the channel could still push the cryptocurrency to the recent lows at $90.5K or $85K.