An experienced writer with practical experience in the fintech industry. When not writing, he spends his time reading, researching or teaching.

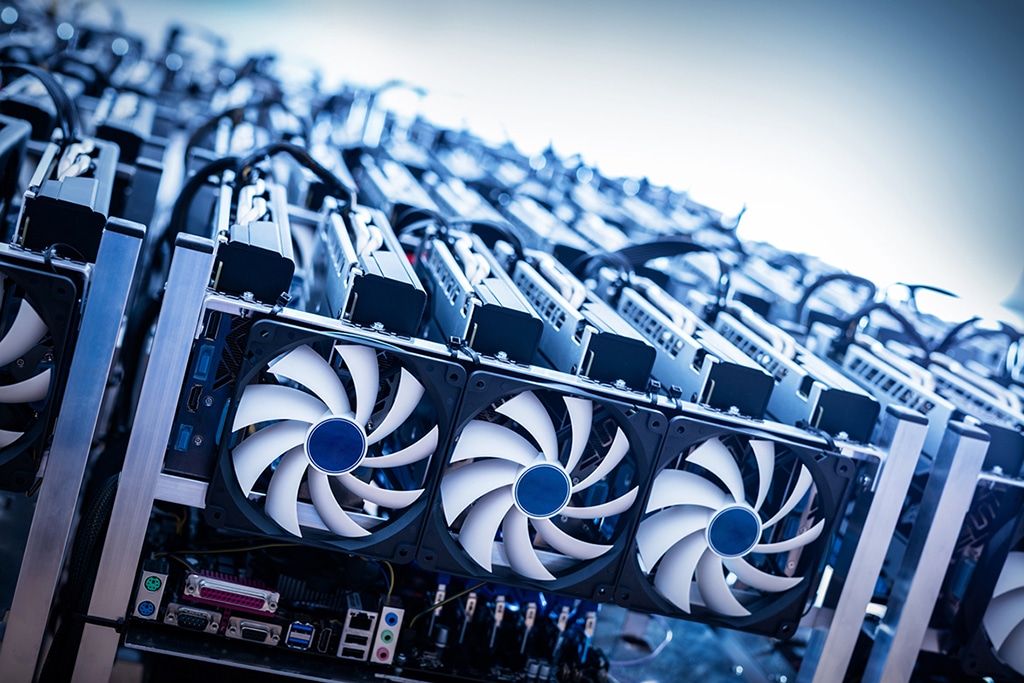

With its high energy consumption remaining a challenge, the growth of crypto mining may stall unless miners embrace more sustainable energy sources.

Following a minor bull run over the weekend, bitcoin mining revenue has increased by up to 50% in the first month of 2023. Rising energy costs, geopolitical tension, and a prolonged crypto winter made 2022 a hard year for the bitcoin mining community. By December, the Bitcoin mining revenue had dropped to just $13.6 million.

After struggling for survival for months, many mining companies were forced to cease operations. One of the largest bitcoin mining companies globally, Core Scientific, filed for bankruptcy after recording a net loss of about $435 million between September and December.

All of that seems like long history after a minor bull run by Bitcoin saw the industry revenue grow by at least 50%. From $15.3 million on Jan. 1, the revenue grew to about $23 million by Jan. 30. through mining rewards and transaction fees.

Meanwhile, the Bitcoin mining difficulty also continued to increase with more miners returning to the fold. Compared to the 26.64 trillion reading on January 21, the latest reading stood at 39.35 trillion at block height 774,144, amounting to a 48% increase in mining difficulty.

Historically, periods of higher network difficulty have always been followed by higher bitcoin prices. Should this happen, this will mean higher bitcoin mining revenue for miners. Contrarily, when prices fall, bitcoin miners go offline as mining becomes unprofitable. The network difficulty also reduces.

Similarly, the Bitcoin mining hash rate has increased to its all-time high. At the time of writing, the hash rate was at 311 exahashes per second (EH/s). The hash rate is expected to continue to increase as more miners return to the network.

With its high energy consumption remaining a challenge, the growth of crypto mining may stall unless miners embrace more sustainable energy sources. Recently, Gridless Compute began testing out a new mining site in Malawi. The company hopes to utilize the stranded energy from the country’s river-based hydropower plant.

Crypto mining companies can also tap into surplus energy generated from renewable sources. For example, in 2021, Marathon Digital Holdings pulled excess energy from a Texas wind farm. This helped to stabilize the wind farm output and avoid congestion.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

An experienced writer with practical experience in the fintech industry. When not writing, he spends his time reading, researching or teaching.