With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

Reducing mining difficulty leads to a decline in the network’s overall hashing power. This change can benefit smaller miners, who will face less competition and potentially return to profitability.

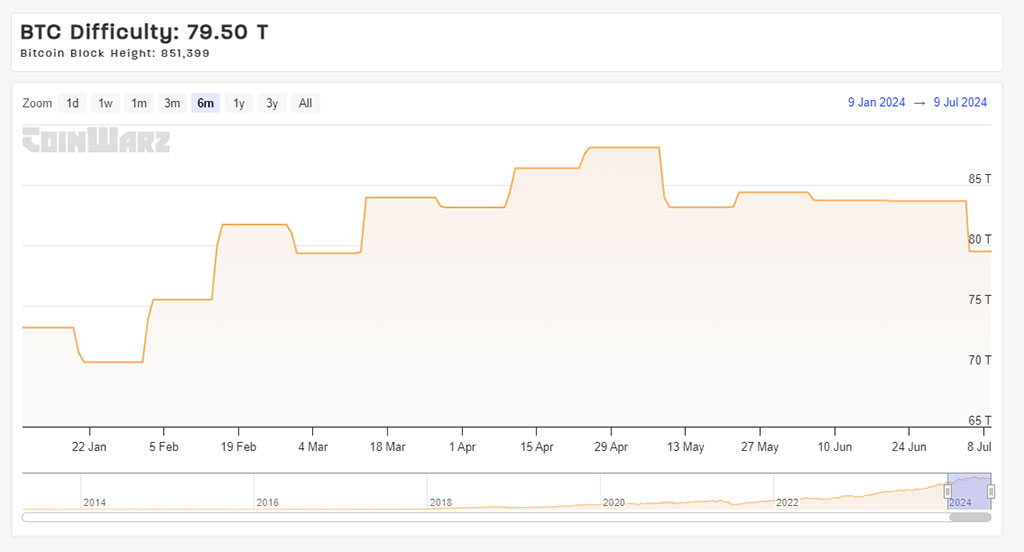

As Bitcoin’s mining difficulty drops significantly, miners may soon experience get relief, according to Coinwarz data. This decrease in computational power needed to validate transactions could signal a period of increased profitability for miners, particularly smaller ones that struggled after the recent halving event.

On June 5, Bitcoin’s mining difficulty plummeted by 7.8%, dropping from 83.6 terahash per second (TH/s) to 79.50 TH/s, effectively returning to pre-halving levels and sparking hope for miners. The Bitcoin network automatically adjusts its difficulty every two weeks to maintain a consistent block generation time of around 10 minutes.

Photo: Coinwarz

The recent decline marks one of the steepest falls since the FTX collapse in December 2022, which triggered a downward spiral in Bitcoin prices, with a 10% drop within a week. Analysts at CryptoQuant, a crypto data provider, spot a clear parallel.

“Network hashrate has experienced a 7.8% drawdown, which is comparable to post FTX collapse on December 2022 […] Miners’ profitability has been hit as the daily revenues fell from $78 million pre-halving to $26 million currently,” said Julio Moreno, head of research at CryptoQuant.

According to Moreno, the decrease in difficulty stems from a decline in hashrate that began in early May, likely due to miners shutting down operations due to squeezed profit margins.

Reducing mining difficulty leads to a decline in the network’s overall hashing power. This change can benefit smaller miners, who will face less competition and potentially return to profitability. High difficulty levels previously forced some miners to shut down their rigs as operation costs exceeded reward earnings.

While a lower difficulty may bring a temporary reprieve, it’s essential to recall that miners are a significant source of selling pressure on Bitcoin in June. Over two weeks, they sold over $1 billion worth of BTC as the price fluctuated between $65,000 and $70,000.

The selling pressure, combined with other factors like the ongoing Mt. Gox saga and a German government entity selling its Bitcoin holdings, further pressured the market, driving the price down to a low of $53,500 last week.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.