Marathon Digital and Riot Platforms, sensing the potential for increased demand, have made strategic moves to fortify their positions in the market.

In the last 24 hours, Marathon Digital Holdings Inc (NASDAQ: MARA) has witnessed a remarkable 105 million shares in trading volume, surpassing established blue-chip stocks such as Tesla Inc (NASDAQ: TSLA), Apple Inc (NASDAQ: AAPL), and Amazon.com Inc (NASDAQ: AMZN), according to data from Yahoo Finance.

Marathon Digital Shares Records Rising Trading Activity

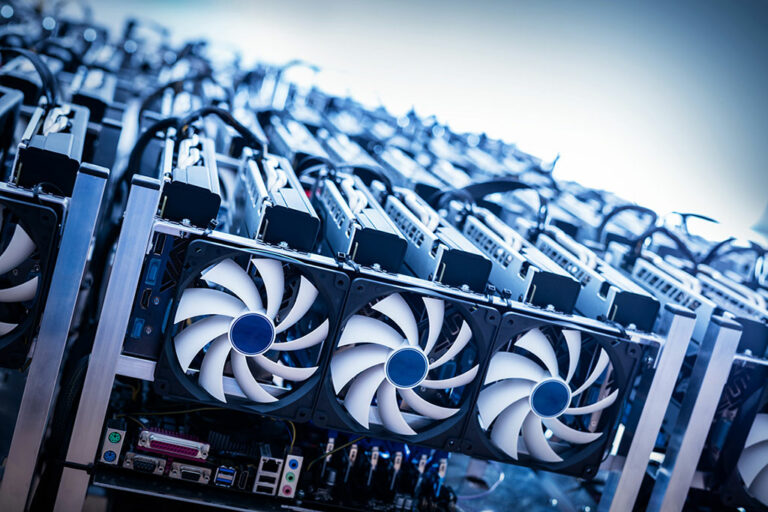

Marathon Digital’s exceptional trading volumes are part of a broader trend in the crypto mining sector. The push to expand operations ahead of the expected spot Bitcoin ETF approval and the Bitcoin halving in April has prompted mining firms to bolster their capacities and gain attention from investors.

The SEC is slated to decide on the Bitcoin ETF by January 10, 2024, and if approved, it is anticipated to trigger a remarkable influx of capital into the market. Leading asset management firms such as BlackRock Inc (NYSE: BLK) and Grayscale Investments are among the major applicants for the spot Bitcoin ETF, further fueling positive sentiment.

Adding to the positive outlook is the upcoming Bitcoin halving event scheduled for April 2024. This cyclical occurrence, happening approximately every four years, entails a halving of the rate at which new Bitcoin is released into circulation.

The objective is to create scarcity and maintain a high demand for the cryptocurrency. Historical records indicate that previous halving events have consistently triggered price surges, and the upcoming one is expected to be no exception. Investors are eyeing this event with anticipation as a potential catalyst for further gains in the crypto market.

Riot Platforms Inc (NASDAQ: RIOT), another key player in the Bitcoin mining space, has also seen a notable uptick in trading volumes, securing the sixth spot on the charts with over 42 million shares traded in the last day.

Marathon and Riot’s Strategic Moves

Meanwhile, Marathon Digital and Riot Platforms, sensing the potential for increased demand, have made strategic moves to fortify their positions in the market. Marathon recently announced a $179 million investment in two mining centers, adding an additional 390 megawatts of mining capacity to its existing 584-megawatt output. Riot Platforms, not to be outdone, acquired $291 million worth of Bitcoin mining rigs, marking the largest increase in the firm’s hash rate in its history.

While Bitcoin has experienced remarkable growth in 2023, with a gain of over 163% since the beginning of the year, shares in Bitcoin miners have outperformed even the leading cryptocurrency. Marathon Digital and Riot Platforms have posted staggering gains of 767% and 452%, respectively, year-to-date, according to data from TradingView. The performance of these stocks highlights the growing recognition of the importance of mining operations within the broader crypto ecosystem.

Whether this trend will continue depends on regulatory decisions, market dynamics, and the unpredictable nature of the crypto landscape. Investors and enthusiasts alike will be closely watching developments in the coming weeks as the crypto market navigates these critical junctures.

next