As Ripple was alleged for conducting unregistered securities offerings worth $1.3-bn, the price of XRP against USD and other currencies offered dropped sharply. XRP/USD hit the lowest $0.18163 yesterday as XRP holders transfer their tokens to exchanges to sell. Among the exchanges that delisted Ripple are Coinbase, OkCoin, Bitstamp, Crypto.com. That for the rest of the crypto-market should trigger a positive mindset as there will be more free money on the market and that could boost the rise of other cryptocurrencies, mainly Bitcoin.

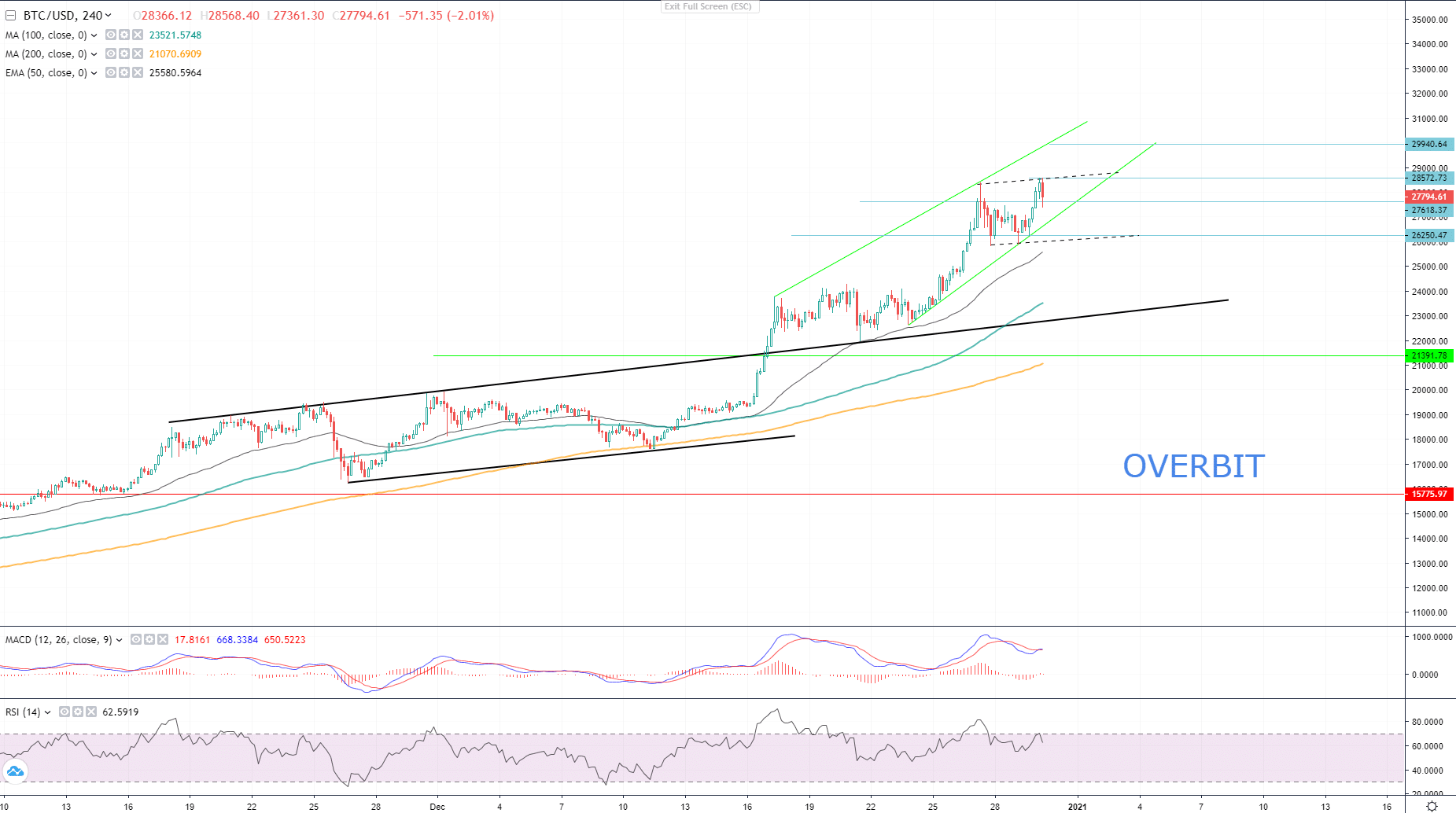

BTC/USD hit another ATH today $28,571.61 and reversed to test the previous highest close. The good news is that Bitcoin tested the level aforesaid as support at $27,618 and remained above it. There is also a candle formation which many times during the skyrocket of BTC this year confirmed the uptrend. Take a close look at the red candle and its wick, whenever there is a long lower wick and the price is above any static support, it mostly signals for another hike.

Based on the chart analysis, I believe the uptrend will continue until the upper band of the ascending channel is hit. After the test of the upper band, BTC may either drop to $28,500 or break it with a heavy impulse and continue upwards.

If the pair closes below the $27,700 – $27,618 support level, it will drop towards support at $26,250 and below that towards $25,900.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Senior Vice President at Overbit. Technical analyst, crypto-enthusiast, ex-VP at TradingView, medium and long-term trader, trades and analyses FX, Crypto and Commodities markets.