With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

Fidelity’s FBTC, the once-hot ETF, bore the brunt of the selling pressure, seeing its second-largest net outflow day ever with $106 million leaving the fund.

Edited by Julia Sakovich

Updated

2 mins read

Edited by Julia Sakovich

Updated

2 mins read

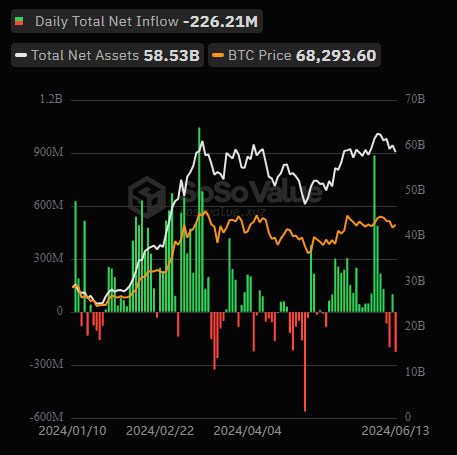

Investors appear to be cooling off on US spot Bitcoin ETFs, with these funds experiencing a significant net outflow yesterday. Data from SoSoValues reveals $226.21 million, leaving these ETFs, which allow traditional exchange-traded fund structures to offer exposure to Bitcoin.

Photo: SoSoValue

Fidelity’s FBTC, the once-hot ETF, bore the brunt of the selling pressure. It saw its second-largest net outflow day ever, with a staggering $106 million leaving the fund. This follows a period of strong inflows for FBTC, highlighting the potential volatility of investor appetite in the crypto space.

While FBTC experienced the largest outflow, other major players in the spot Bitcoin ETF market also saw outflows. Grayscale’s GBTC lost $62 million, and Ark Invest and 21Shares’ ARKB saw $53 million leave. Even smaller players like Bitwise and VanEck witnessed net outflows of around $10 million each.

However, there was one bright spot. BlackRock’s IBIT, the largest spot Bitcoin ETF by net asset value, went against the trend and recorded net inflows of $18 million. This suggests that some investors still believe in Bitcoin’s long-term potential.

Despite yesterday’s outflows, it’s important to keep the bigger picture in mind. Since their launch in January, US spot Bitcoin ETFs have collectively accumulated a staggering $15.30 billion in net inflows. This indicates that, overall, investor interest in gaining exposure to Bitcoin through ETFs remains strong.

While Bitcoin ETFs face a temporary setback, the regulatory outlook for Ether ETFs is improving. SEC Chair Gary Gensler recently indicated that a decision on spot Ether ETFs might come this summer. This could be a major development, possibly attracting new investments into the cryptocurrency market.

Analysts at JPMorgan predict that spot Ether ETFs could launch before November, capturing up to 20% of the investments currently going into spot Bitcoin ETFs. However, there are concerns. Crypto derivatives trader Gordon Grant notes that the lack of staking options in these Ether ETFs due to regulatory uncertainty might deter institutional investors.

At the time of writing, Bitcoin price stands at $66,946, marking a slight 0.75% decline in the last 24 hours and around 6% decline over the past week amid the flat consumer price index (CPI) for May.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.