Bitcoin developer Adam Back clarified that this legal fine print in the video reflects BlackRock’s lack of control over Bitcoin’s decentralized protocol.

Bitcoin developer Adam Black has issued a statement clearing the air over the recent controversy surrounding a video by asset manager BlackRock which shows that the total Bitcoin BTC $96 611 24h volatility: 2.1% Market cap: $1.92 T Vol. 24h: $29.09 B supply of 21 million isn’t fixed. In its three-minute Bitcoin explainer video, BlackRock stated that there’s no guarantee that the Bitcoin supply cap won’t change.

As we know, Bitcoin’s fixed supply of 21 million is one of its major USPs as a store of value, and increasing this could lead to the asset’s devaluation. Following this controversy, one X user questioned Bitcoin developers over their silence on the matter. “Bitcoin’s decentralization and principles should be defended loudly, not left in the shadows of corporate influence,” noted X user Sebastian.

Prominent Bitcoin developer Adam Back addressed concerns surrounding a disclaimer in a BlackRock promotional video. Back further talked about the disclaimer which mentions that there’s no guarantee the cap could not change. What drew investors’ attention is that MicroStrategy chairman Michael Saylor posted the same video on his X account timeline.

The Bitcoin developer said the intent behind the disclaimer, stating that it is likely a precautionary measure from BlackRock’s legal team. “Obviously their lawyers made them write that as they sell investment products and they don’t have control,” he wrote.

He further noted that BlackRock’s disclaimer merely acknowledges the company’s lack of influence over Bitcoin’s decentralized protocol. “It’s just legal fine print saying BlackRock can’t guarantee that — because if the community tried to do it, there’s nothing they could do about it,” Back said. He further added that such a change is improbable given Bitcoin’s robust community consensus.

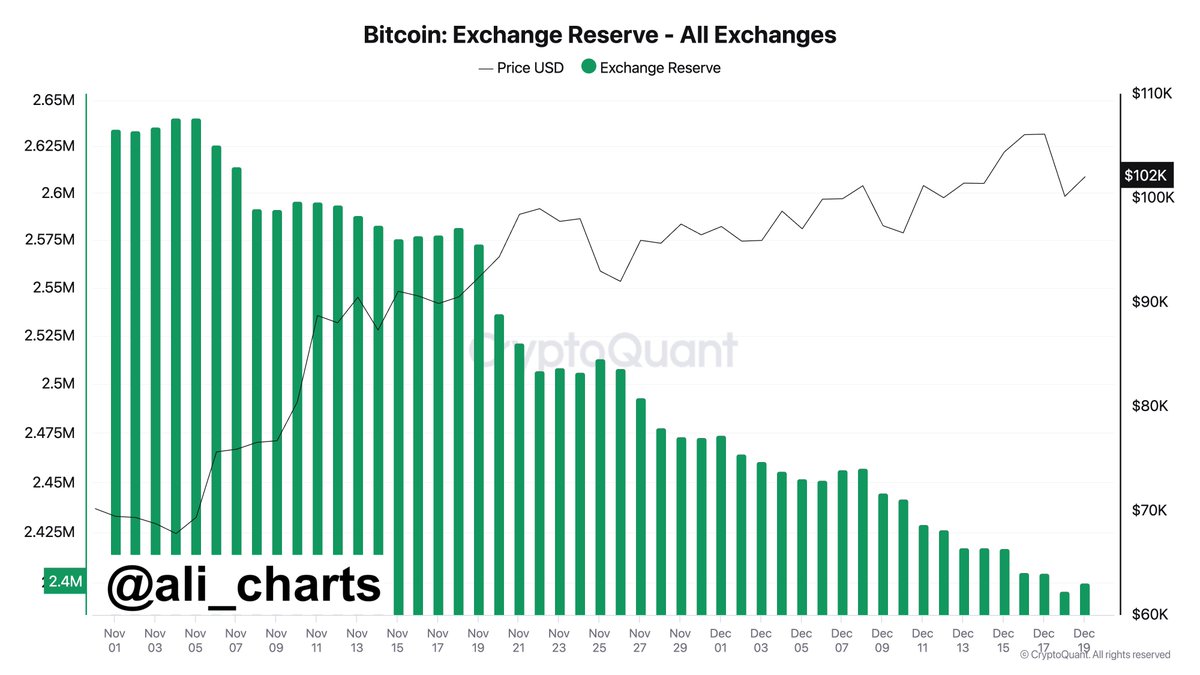

Bitcoin Exchange Supply on a Decline

Following Donald Trump’s victory last month in early November 2024, Bitcoin price saw a dramatic rally surging all the way to an all-time high of $108K earlier this week. This BTC price surge comes along with strong on-chain metrics and a reduction in exchange supply.

Cryptocurrency market analyst Ali Martinez has highlighted a significant trend in Bitcoin (BTC) activity this month. According to Martinez, a total of 74,052 BTC moved out from exchanges in December alone, indicating a surge in off-exchange storage. “This trend doesn’t seem to be slowing down!” Martinez noted further.

-

Source: Ali Charts

However, following the all-time high earlier this week, Bitcoin is seeing strong selling pressure correcting more than 10% from the top. As of press time, BTC price is trading 7.5% down at $94,882 with its market cap around $1.878 trillion.

next