Circle’s app that has already been available in the USA is expanding its services for UK citizens who can now instantly send value without fees and with the convenience of sending an email or text.

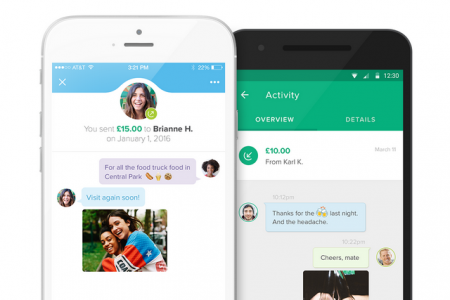

Circle has updated its apps for Android, iOS, and the Web for the UK citizens. Now they can make social payments over the open Internet in their native currency, pound sterling (GBP). Customers in the UK can also transfer money with messages and emojis, and make currency transfers between pounds and dollars.

Circle enabled dollar support in the USA last year, however the company doesn’t disclose any information about the number of customers using the service. Company is planning to add Euros later. Circle also eliminates transaction and withdrawal limits for all 150+ countries where service is available.

Circle’s app is now launching in the UK with the support of Barclays. The Financial Conduct Authority has issued an e-money license to Circle. The license grants about 80 such permissions although this is the first one for a company operating a digital currency. The FCA does not regulate bitcoin.

“For the first time ever, any consumer in the US or UK can instantly send value, without fees, and with the convenience of sending an email or text. US dollars and pound sterling are becoming more digital and global,” said Jeremy Allaire, co-founder and chief executive of Circle.

According to Allaire, customers will get access to money transfers without fees although will not be able to buy bitcoin through the app. Circle uses bitcoin as a way to facilitate transfers for customers outside its own system. Barclays will hold customers’ deposits and provide mechanism to make transfers from any UK bank account in and out of Circle.

Harriett Baldwin, economic secretary to the Treasury, stated: “Circle’s decision to launch in the UK and the firm’s new partnership with Barclays are major milestones. Together they prove our decision to introduce the most progressive, forward-looking regulatory regime is paying off and cements our status as the world’s FinTech capital.”

Barclays said: “We can confirm that Barclays Corporate Banking has been chosen as a financial partner by Circle, and we support the exploration of positive uses of blockchain that can benefit consumers and society.”

Circle has once become the first company to get a bitcoin license from New York State’s financial regulator. While initially the company had been dissatisfied with the BitLicense’s requirements, later some kind of compromise was found and Circle agreed to the irrefutable requirements for operating with bitcoin. Having got the BitLicense, Circle came up with the app developed specifically for those who seek for free, safe and instant transactions and don’t want to run the risk because of volatility of a particular currency.

next