Arbix Launched Its New Arbitrage Earning Protocol to Boost Profit

Arbix Finance created the protocol. In this article, we will take a closer look at this company and its new protocol.

What Is Arbix Finance?

Arbix Finance is a yield farming platform based on Binance Smart Chain that utilizes arbitrage to gain optimal yield with minimal risks. So, users can deposit BEP20 token assets into the vaults and grab their profits.

Unlike many yield farming platforms, users do not have to worry about impermanent losses since all vaults are single-asset.

Arbix Finance and Its Mission

It is important to note that the platform plans to contribute to the blockchain and decentralized communities. The platform stands out among its competitors and has already found its target audience of users.

The platform has two main missions:

- Decrease pricing discrepancies among Dexs thanks to the unique protocol.

- Create single-asset vaults to increase profits without distributing governance tokens.

What Is Arbitrage Earnings Protocol?

The platform designed to increase returns on Binance Smart Chain has invented a new protocol named “Arbitrage Earnings Protocols”.

It enables optimal profits from simultaneous buying and selling the same asset on different DEXs having low risks. So, tokens can be exchanged between DEXs simultaneously in a single transaction. As a result, its users gain skyrocketing profits and increased APR.

Thanks to the Arbitrage Earnings protocol, a wide set of options for DEX assets and connections, the number of which directly affects arbitrage opportunities.

Arbix Finance plans to connect more DEXs, add new assets, and expand the platform’s capabilities. In addition, it has already established fruitful partnerships with four major decentralized exchanges: PancakeSwap, MDEX, Biswap and ApeSwap.

For Users

With Arbix Finance, users can place assets on BEP20 tokens in vaults and earn competitive yields. Unlike many yield projects, the platform allows its users not to worry about losses because all Arbix vaults are single-asset.

It focuses on the security and protection of assets, personal info and vaults. Therefore, Arbix vaults were audited by the leading security company CERTIK.

Arbix was designed as a secure space to store funds safely and enjoy everything the platform has to offer.

Basics

In the blockchain, a vault is essentially a safe space for storing assets. Assets in the context of the Binance Smart Chain are BEP20 tokens.

The platform aims to provide only zero-impermanent-loss vaults. Thus each of the vaults is only designated to a corresponding single asset.

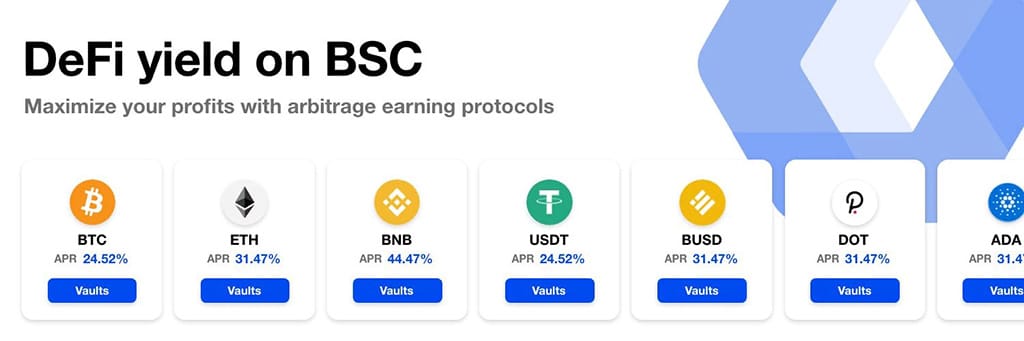

Here are the lists of platform active BEP20 vaults:

- ADA – Cardano

- BNB – Binance Coin

- BTCB – Binance-pegged BTCB Token

- BUSD – Binance USD

- CAKE – PancakeSwap

- DOGE – Dogecoin

- DOT – Polkadot

- ETH – Binance-pegged Ethereum Token

- LINK – Chainlink

- USDC – USD Coin

- USDT – Tether

- XRP – Ripple

These assets are available on many platforms, which enables their successful use in arbitrage protocol and yield farming (Venus protocols and Autofarm network).

Fees

The entry fee for Arbix is 0.1% of the deposit amount in each vault. Yet, the commission varies from the depository to the depository depending on the connected DEX. Usually, the overall fee does not exceed 0.2% of the amount stored. While a 2% performance commission is charged regularly by the platform, Arbix has eliminated the fee for all users for two months to honour the Beta Launch.

To Sum It Up

It is still a completely new platform, and it is a combination of an excellent protocol and a set of fruitful collaborations. Arbix provides its customers with transparent solutions in the crypto world and shows a trustworthy and secure platform.

In addition, this platform also offers the lowest commissions on the market and takes care of its users. With Arbix Finance and its protocol, you can earn money, and you don’t need to worry about security.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.