Ripple Price Prediction: Historical Analysis Suggests XRP Could Have Reached Generational Bottom After Recent Crash

/StratoVM/ – XRP just took a big hit, but some analysts see it as a potential turning point — one of those deep pullbacks that historically lead to major comebacks.

With XRP’s track record of bouncing back from rough drops, traders are keeping a close eye on whether this is just another dip or the start of something bigger.

At the same time, StratoVM ($SVM), an EVM-compatible layer 2 solution, could help Bitcoin tap into the DeFi space — an area where BTC has always lagged behind.

Let’s check out the details…

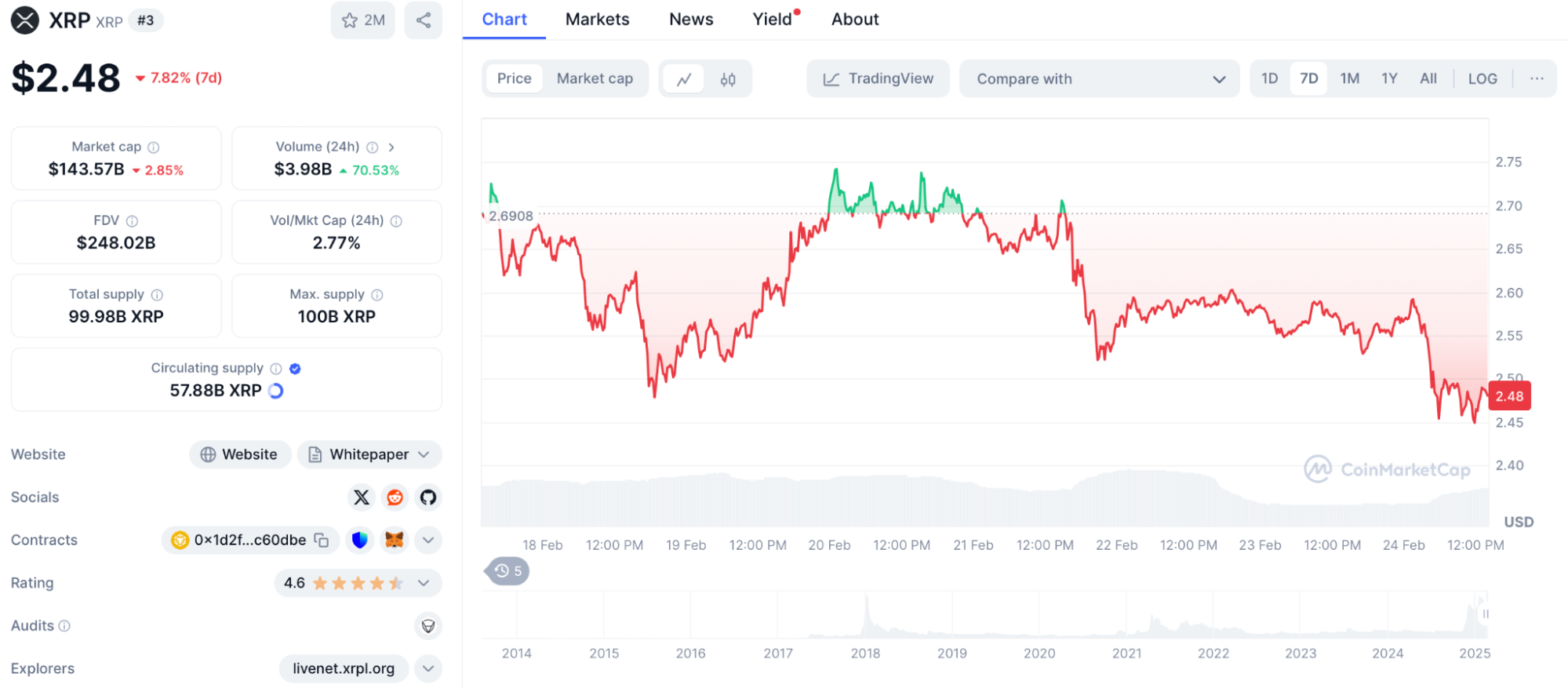

Ripple Price Prediction: Has XRP Hit a Generational Bottom?

XRP’s recent crash has traders questioning whether this is just another dip or a true generational bottom — a price level so low that it may not be seen again for years. Historical trends suggest XRP has gone through similar deep corrections before bouncing back with massive gains.

For instance, XRP saw a 70% crash after the SEC lawsuit in 2020 and another 55% drop during the 2020 market downturn, both of which set the stage for major rallies. Analysts now point to the latest over 40% decline as a potential repeat of history.

While whales offloaded millions of XRP during the sell-off, some traders see this as a chance to accumulate before the next move up.

If XRP follows past patterns, this dip could mark the beginning of another major rally — but only time will tell if history truly repeats itself.

StratoVM: Could This Layer-2 Finally Bring DeFi to Bitcoin With Faster Transactions and Ethereum Compatibility?

StratoVM ($SVM) is a Layer 2 blockchain for Bitcoin that enables smart contracts, memecoins, AI, and DeFi applications directly on the Bitcoin network.

Currently trading at $0.01436, StratoVM has surged 426% over the past week, according to CoinGecko. This impressive rise underscores its resilience amid market fluctuations, fueled by its potential to address Bitcoin’s scalability challenges.

SVM 7-day chart, Source: CoinGecko

StratoVM is preparing for its mainnet launch, a key milestone in its evolution. Compared to other Bitcoin Layer 2 solutions like CoreDAO, which holds a fully diluted valuation of $990M, StratoVM remains notably lower at around $3M.

A successful mainnet launch could serve as a strong bullish catalyst, potentially making StratoVM significantly undervalued at its current valuation.

According to DeFiLlama, the total value locked in BTCFi protocols has surged from $307 million in January 2024 to $6.6 billion in February 2025. With its innovative approach, StratoVM is well-positioned to tap into this growing sector.

Additionally, SVM’s listing on UniSwap further enhances its credibility, making it a project worth closely monitoring.

StratoVM has built a thriving ecosystem, backed by 50+ strategic partners driving innovation and growth. Speculation about an upcoming CEX listing is gaining traction, which could serve as a strong bullish trigger for the project.

The community is also showing strong interest, with nearly 100,000 followers across its official X, Telegram, and Discord channels.

As Bitcoin’s role expands beyond being just “digital gold,” StratoVM’s scalability and security could position it as a leading force in BTCFi, unlocking a massive untapped market. With the mainnet launch approaching and momentum building, a CEX listing post-launch wouldn’t be surprising.

Also, the testnet showcases that it’s capable of delivering with over 113,312 registered wallet addresses and more than 56,200 daily transactions.

Wrapping Up

Despite XRP’s steep drop, history suggests it could be setting the stage for another major rebound. If past trends hold, this downturn might be an opportunity rather than a setback.

At the same time, Bitcoin might be on the verge of a different kind of breakthrough — not in price, but in functionality.

StratoVM ($SVM) could finally bring DeFi to BTC, which should make it faster, more usable, and open the door to Ethereum-style apps.

Remember, this article is not financial or trading advice. All cryptocurrencies are volatile, and past performance is not a guarantee of future results. Always conduct your own research and/or consult with experts before making any crypto-related decisions. Trade responsibly. Forward-looking statements are uncertain and might not be updated.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.