With states and financial institutions turning their attention towards cryptocurrency and blockchain assets as a new asset class, regulatory concerns have now become of paramount importance to proliferating tokenized securities on the Ethereum blockchain.

Ambisafe, global blockchain services company, is proposing a new regulation aware protocol (RAP) token through Orderbook, a decentralized token exchange. The self-regulating token class designed to facilitate the management of securitized tokens on Ethereum via a whitelist that will govern the buying, selling and trading of assets.

This will go some way towards solving the complication of having various regulatory guidance, that are emerging from different blockchain startups, with differing compliance mechanisms being created around the specific jurisdictions of each token.

For project owners, navigating this complex minefield of compliance can be difficult, particularly when concerning Anti Money Laundering (AML) and Know Your Client (KYC) acts that apply to crowdfund contributors and asset purchasers.

A Cross-jurisdiction Regulations Compliant Assurance

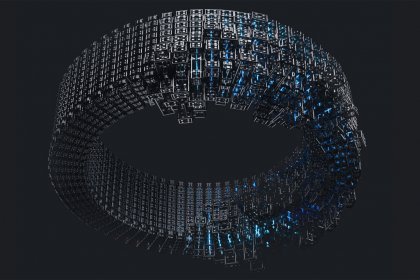

Orderbook is a decentralized token exchange and token generation event platform built on the Ethereum protocol, featuring its native RAP token powered by smart contracts that ensure all individuals attempting to transact in securities must obtain the necessary permissions to do so.

Relevant smart contracts will check each transaction attempt against an internal database, restricting users, who cannot fulfill requirements for completing the transaction.

More than allowing project owners to comply with various regulatory requirements, RAP also improves the user experience, eliminating the need to submit credentials for verification with every interaction with a new security token. Each individual’s current unique information is maintained on the RAP database, allowing them to openly interact with any token generation event matching their compliance levels.

Ambisafe founder and Orderbook CEO Andrii Zamovskyi iterated that RAP tokens would represent the relevant tool for financial innovation, facilitating the bridge between existing and emerging financial instruments. He believes in the migration of financial markets to this new technology in the near future.

The Secure Decentralized Exchange Supporting Verified User Databases

Orderbook is the only exchange that can create and support relevant registries for verified blockchain users, storing them in smart contracts. To date, it has recorded over 30,000 contracts deployed, and 12 token generation events, raising $35 million. As industry players recognize the value of verified user databases, Orderbook believes that more token creators will incorporate RAP tokens into their solutions.

With a multi-crypto wallet, allowing to store most major digital tokens and cryptocurrencies in one place, a dashboard, which announces every new token generation event, which have passed mandatory compliance checks, and a trading platform with publicly accessible trade history, which prevents order book manipulation, Orderbook is the single platform, one-stop solution for all trading and token sale needs of crypto enthusiasts.

next