With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

The positive sentiment is driven by the world’s largest assets manager firm BlackRock recently announcing its tokenized fund targeting Ethereum’s BUIDL products.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

The cryptocurrency market commenced the Asian trading session bullishly, propelled by favorable occurrences and an immense short squeeze. Bitcoin (BTC) and Ethereum (ETH), the leading cryptocurrencies, soared, with over $100 million in leveraged short positions liquidated within the past 24 hours.

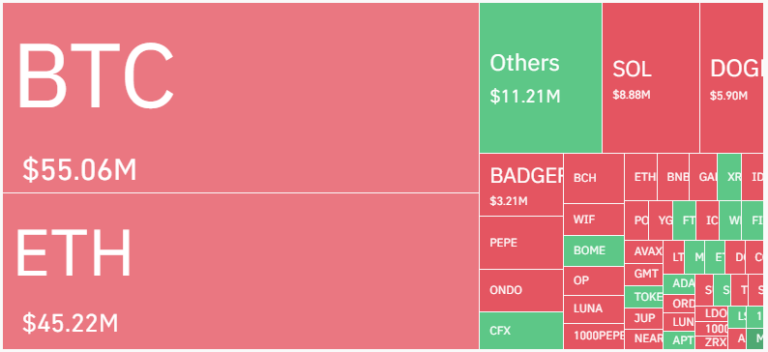

CoinGlass data revealed a substantial liquidation occurrence. Leveraged futures positions worth over $100 million faced forced closure during the last 24 hours, with roughly $55 million stemming from short bets on Bitcoin and $45 million from short positions on Ether. These short sellers, anticipating price declines, were caught unawares by the abrupt uptick and face considerable losses.

Photo: CoinGlass

Cryptocurrency’s future appears promising due to the broader economic landscape. The Swiss National Bank’s unexpected rate reduction signifies global central banks adopting looser monetary policies. This easing cycle benefits the premier cryptocurrencies like Bitcoin and Ethereum.

Similarly, dovish stances from Mexico’s central bank, coupled with hints from major institutions like the Federal Reserve, European Central Bank, and Bank of England, suggest potential liquidity injections in the coming months, fostering a bullish environment for cryptocurrencies.

Jeroen Blokland, The Founder of Blokland Smart Multi-Asset Fund, commented on current investment trends, emphasizing optimistic outlooks for cryptocurrencies, stocks, gold, and real estate. Despite anticipating a market correction, He expressed confidence in these diverse assets’ medium-term performance.

The cryptocurrency’s recent price surge and short squeeze stress the sector’s transformative landscape. While short-term volatility persists, rising institutional interest and favorable economic conditions suggest potential for long-term growth. Short-term swings are typical, yet more stakeholders and a supportive environment may foster sustained advancement.

According to CoinMarketCap, Bitcoin surged 3.15% in the past 24 hours, reaching $67,970. While the Ethereum mirrored this positive sentiment with a 2.60% gain, currently trading above $3,500. The CoinDesk 20 (CD20), a benchmark for the top 20 most liquid cryptocurrencies, reflected this broader market optimism, climbing roughly 3% at the time of writing.

Despite the potential for short-term volatility, yet cryptocurrencies show potential for long-term gains. A global easing cycle could increase liquidity and investments in digital assets, potentially boosting prices further. However, this outlook relies on anticipated economic conditions unfolding as expected.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.